A year and a half ago you we advised to buy centrally located properties suitable for short-term rental. Our arguments were several - supply on the Airbnb and Booking.com platforms was at record low levels, mortgage interest rates too, and alternative investments such as stocks and cryptocurrencies carry many risks.

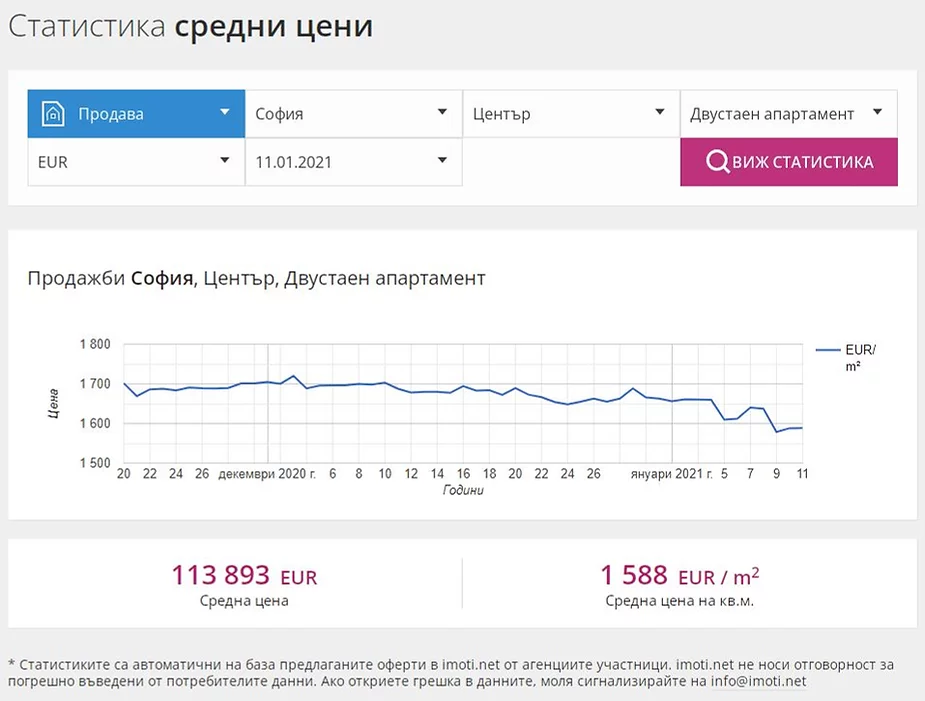

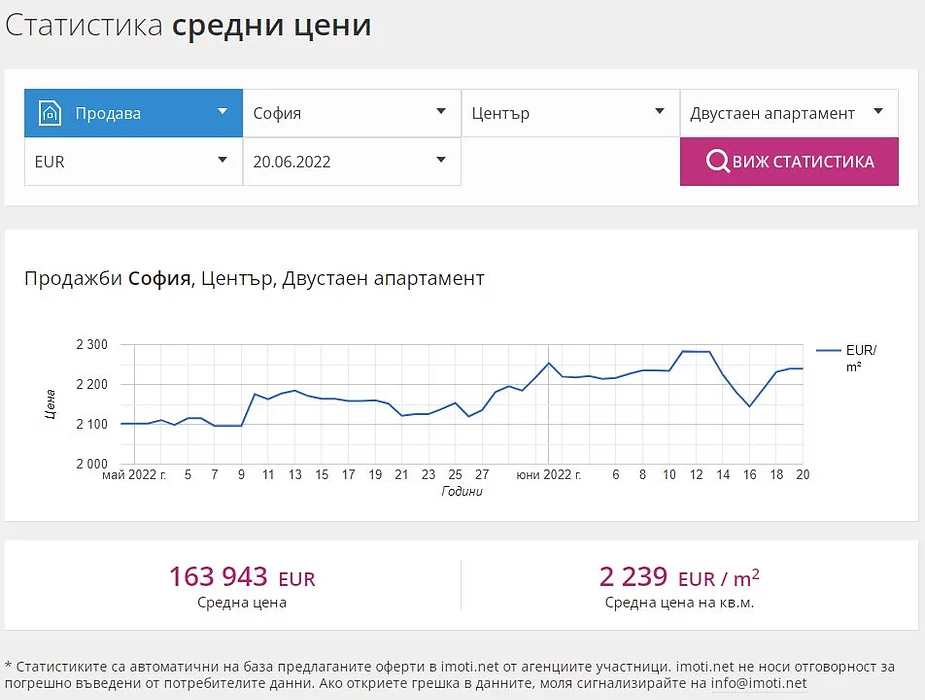

The balance to date for the purchase of a two-room apartment in the center of Sofia in January 2021 would be as follows:

- The price of the property would have risen by about 40% according to data on the portal Imoti.net or 20% according to imot.bg. We take the average value – 30%.

- By renting out the property short term you would have received an additional around 9% return on investment over 18 months.

BGN 1,000 invested in a property in the center of Sofia 18 months ago would be worth BGN 1,390 today.

BGN 1,000 invested in SP500 or Bitcoin at the same time today would be BGN 967 or BGN 592, respectively.

At the end of the article there are graphs that show the price movement. Why our prediction came true and what is to come from here on, read in the following lines...

In the middle of the party

Over the past decade, the property market has gone through the two most favorable phases of its cycle – recovery and expansion. The last 18 months can be likened to the climax of a party when:

- Music is the best: interest rates are at their lowest

- Everyone is on the dance floor: massively, people are looking for properties for investment, and also for living

- Consumption is at an all-time high: record number of transactions

- Staff can barely serve everyone: new construction lags behind demand

The reasons for reaching the height of the coupon are many - "cheap" money, low unemployment, rising incomes, protection against inflation, lack of good alternative investments, etc. A different factor this time is the effect of the pandemic, which Georgi Pavlov, CEO of Realto Group, described very accurately in interview for Money.bg – our home suddenly became not only a place to live, but also a place for work, study and even sports, which increased the intrinsic value of housing.

The pandemic is gone and the DJs (central banks) are starting to play music that is not so "danceable". After the party that lasted for a long time, the probability of going to an after-party is small, and we start to look towards the exit of the establishment and think about how we will get home.

The party ends

If you've been to a nightclub in recent years, you've probably seen people inhaling paradise gas from balloons. These bubbles do not burst, but gradually fall, which makes them another appropriate element of our metaphor for the development of the real estate market in our country.

The bubbles will not burst unless we find ourselves in a war, a second Viden winter or another force majeure event with extremely negative consequences for the Bulgarian economy. The coupon will gradually subside as the number of transactions decreases due to the increasing interest rates on housing loans. The rise in prices will reduce its intensity and in the next 6-12 months it will stop. It is possible that a correction will follow, but it is too early to say how big it will be and which properties will be affected. Consumption will shrink in the face of rising household costs and excessive inflation, and when that happens we will enter a recession.

Today the party is coming to an end, and how bad the hangover will be depends on you and the steps you take. Here are our recommendations on how to deal with it.

Recipes to prevent a severe hangover after the property coupon according to the quantity and quality of consumption

You bought a property with a loan

- What to do: As soon as possible, check if you can renegotiate the loan and get the best terms before the interest rates go up.

- How: Use the free service of musketari.bg and quote code FlatMngr , in order to get faster service and save up to BGN 250 in costs that you would otherwise have to pay to the banks for preparing the documents.

You bought an investment property outside the city center in a place where there is new construction and/or the possibility of such construction (vacant plots)

- What to do: Sell the property in the next 3-6 months

- How: contact our digital agency at hello@flats.bg or 0875 333 000 and we'll help sell your property quickly and hassle-free for the lowest commission on the market: 1.5% excluding VAT

You have bought a centrally located, trophy or luxury property.

- What to do: Check if the return on the property is optimized by giving it a yield assessment. If you have a long-term tenant – index the rent to inflation.

- How: Get a free estimate by filling out the form on the page at Flat Manager or take advantage of a free consultation with our team of this link.

You have bought a property in the green or under construction

- What to do: Keep in constant contact with the investor/builder. If you notice irregularities or non-fulfillment of the concluded contract, consult a lawyer.

- How: For legal help in the field of real estate, seek the experts from Gergovski and Partners

You have purchased a vacation property

- What to do: Make sure you're making the most of the tourism recovery and that your property is generating good returns during periods when it's not in use.

- How: Take advantage of a free consultation with our team of this link or write to us at office@flatmanager.bg

You have savings and are hesitating about what to do with them so that they are not "eaten" by inflation

- If you are confident that you will not experience financial difficulties during the expected harsh winter, invest in an already built property in a location where the supply is unlikely to increase from current levels. Also consider investing through online crowdfunding platforms, through which you can achieve better diversification and liquidity.

To contact the Flat Manager: office@flatmanager.bg or 0875333000

Changes in asset prices: