Last update: 05/03/2022

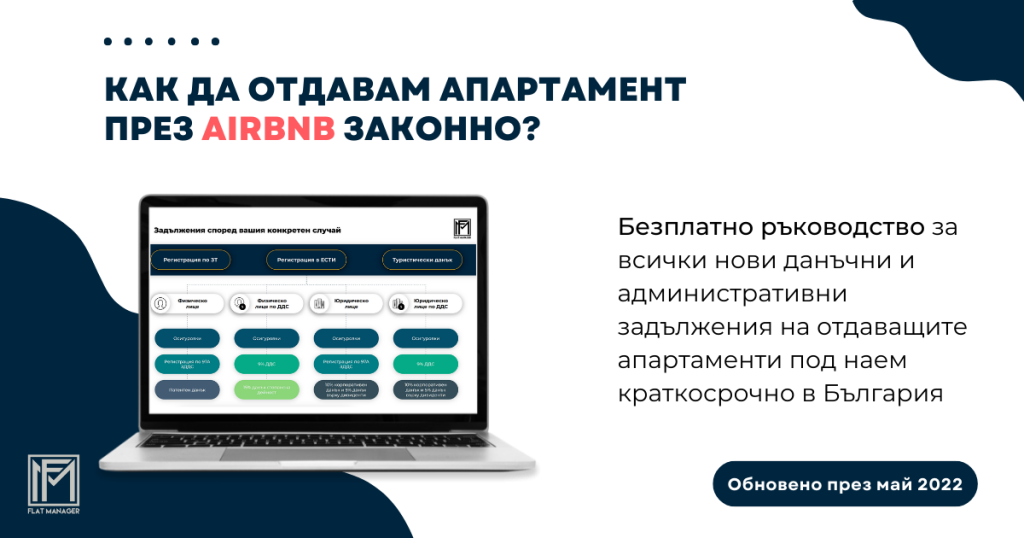

Last update: 03/05/2022 How to rent out our apartment through Airbnb and Booking.com legally? Is the consent of the neighbors necessary? What taxes do we have to pay? What are our administrative duties? Find the answers to these questions in Flat Manager's free guide. Creating a legal framework to regulate short-term rentals through platforms like Airbnb is a challenge, [...]

Еstablishment of a legal framework for the regulation of short-term rentals. Creating a legal framework for the regulation of short-term rentals through platforms like Airbnb is a challenge that Bulgaria has managed to tackle. The next step is effective enforcement, which more and more countries around the world are delegating to the platforms themselves. In neighboring Greece, publishing a property on the platform requires a registration number, which is obtained in advance from the local authorities. In France, all ads without license plates are subject not only to fines, but also to removal from the platform itself.

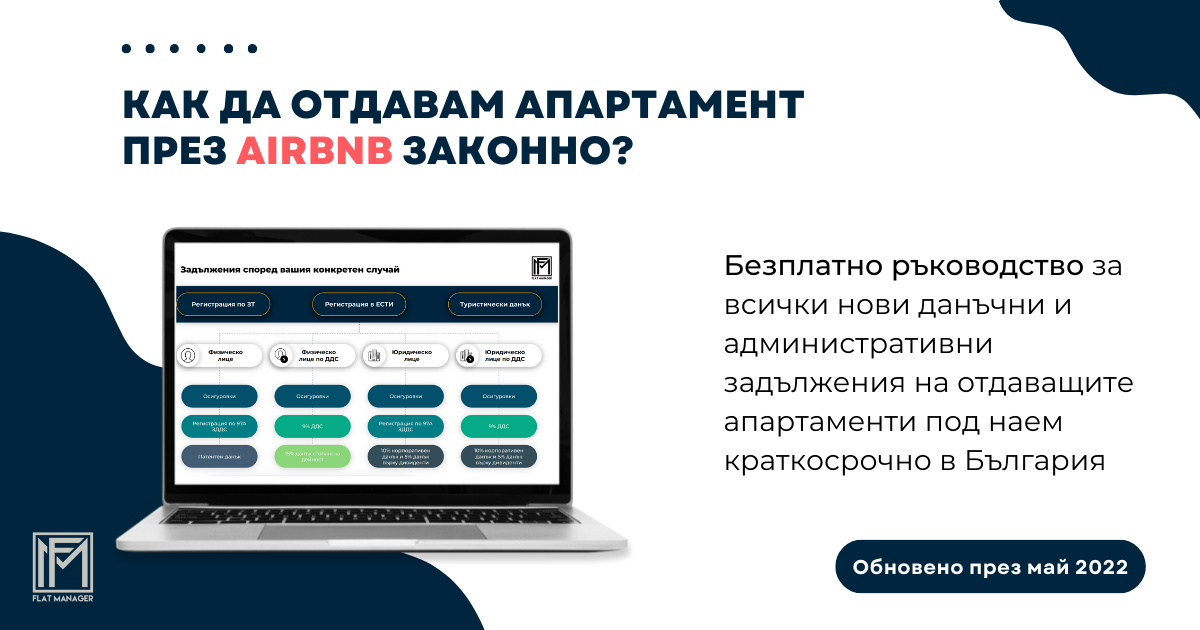

Similar measures will be implemented in Bulgaria in a relatively short period of time. That is why it is necessary for each owner to be familiar with the administrative tasks that he must perform before starting the activity, which is defined by the Bulgarian legislation as "hotel" and is subject to a registration regime according to the Tourism Law. Before the existence of this regime, we could declare the income from letting out nights as rental income and this was acceptable to the NRA; the rules are different now.

Although the financial obligations are in some cases more profitable if we rent our apartment for short periods to tourists, compared to those for long-term rentals, they are more numerous. An information campaign led by the Association for Tourist Properties and Innovations together with the Ministry of Tourism will soon be launched, but we have decided to prepare a guide with all possible tax and administrative obligations for individuals and legal entities that carry out hospitality activities in apartments.

The information in the handbook has been agreed with all mentioned government bodies and institutions. It is distributed completely free of charge, so you can also share it with your acquaintances who do this activity.

Get the manual

Here are some of the most important points that apply to everyone:

- The apartment must be registered with the municipality as a place of accommodation class "B"

- Neighbors' consent is NOT required

- We must collect the personal data of the guests and enter them into the Unified Tourist Information System ESTI

- We must register for VAT: special registration under Art. 97A or normal registration

- Flat Manager undertakes almost all duties on behalf of its clients completely free of charge – VAT registrations, collection of guest data, declaration of tourist tax